Buying a home is a significant milestone for many people, and securing a mortgage is often the first step. One of the most important factors in getting approved for a mortgage is your credit score. Understanding what credit score you need and how it impacts your mortgage options can help you prepare for the home-buying process. Here’s a comprehensive guide to help you navigate this crucial aspect of home financing.

Why Your Credit Score Matters for a Mortgage

Your credit score is a numerical representation of your creditworthiness. Lenders use this number to assess how likely you are to repay borrowed money. A higher credit score indicates a lower risk for lenders, which can lead to better loan terms, including lower interest rates and higher loan amounts. Conversely, a lower credit score might result in higher interest rates or difficulty getting approved.

What Is the Minimum Credit Score for a Mortgage?

While the minimum credit score required can vary by lender and type of mortgage, here are the general guidelines:

1. Conventional Loans: For most conventional loans, which are not backed by a government agency, a minimum credit score of 620 is often required. However, a score above 700 is typically preferred, as it may qualify you for better terms and interest rates.

2. FHA Loans: The Federal Housing Administration (FHA) insures loans and allows for lower credit score requirements. The minimum credit score for an FHA loan is generally 580, but some lenders may require a score of 620 or higher. FHA loans can be a good option for buyers who have lower credit scores or limited down payment funds, as they only require a 3.5% down payment.

3. VA Loans: Loans backed by the Department of Veterans Affairs (VA) do not have a specific credit score requirement set by the agency. However, most lenders prefer a credit score of at least 620. VA loans are available to active-duty service members, veterans, and eligible spouses, and often offer competitive terms without the need for a down payment.

4. USDA Loans: The U.S. Department of Agriculture (USDA) offers loans to low-to-moderate-income families in rural areas. While the USDA does not have a strict minimum credit score requirement, most lenders require a score of at least 640. These loans can offer low interest rates and require no down payment.

How Credit Scores Impact Mortgage Interest Rates

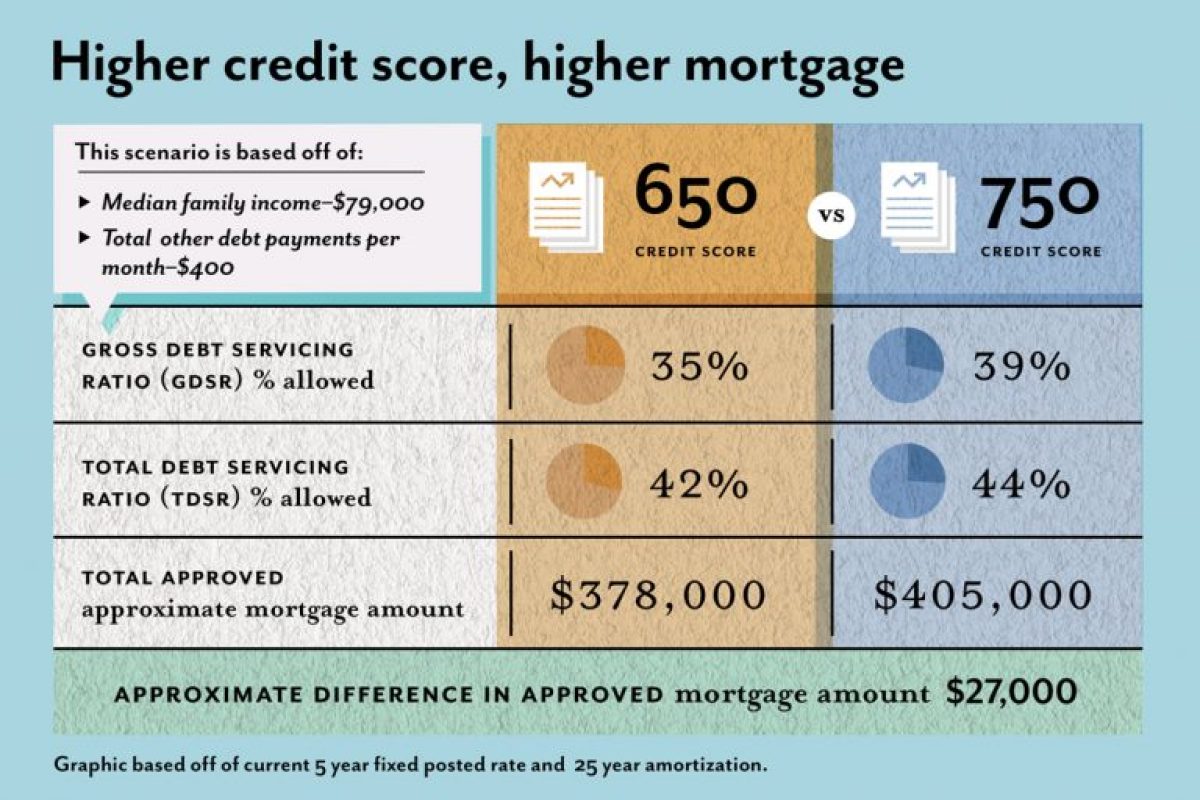

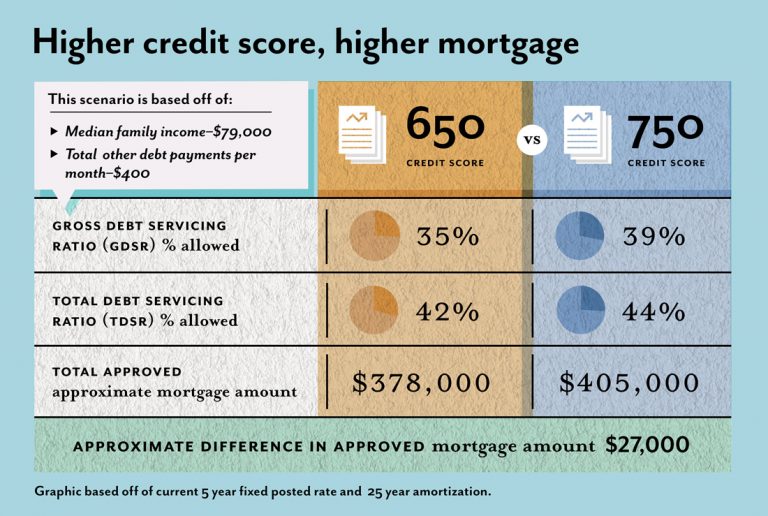

The credit score you bring to the table can have a significant impact on the interest rate you receive. A higher credit score can qualify you for lower rates, which translates to lower monthly mortgage payments and less interest paid over the life of the loan. For example, if you have a credit score of 740 or higher, you may be eligible for the best interest rates available. On the other hand, a score below 620 might lead to higher rates or even make it difficult to get approved at all.

Credit Score Ranges and Their Impact:

- Excellent (750+): Often qualifies for the lowest interest rates and best loan terms.

- Good (700–749): Still qualifies for competitive interest rates, although not the lowest.

- Fair (620–699): May still get approved, but with higher interest rates.

- Poor (below 620): Approval is more difficult and often comes with higher interest rates.

Improving Your Credit Score Before Applying for a Mortgage

If your credit score isn’t quite where you’d like it to be, there are steps you can take to improve it before applying for a mortgage:

1. Pay Down High-Interest Debt: Reducing credit card balances can significantly improve your credit utilization ratio, which is a major factor in your credit score.

2. Pay Your Bills on Time: Payment history makes up 35% of your credit score. Setting up automatic payments or reminders can help you stay on track.

3. Check Your Credit Report for Errors: Mistakes on your credit report can negatively impact your score. Request a free report from all three major credit bureaus (Experian, Equifax, and TransUnion) at AnnualCreditReport.com and dispute any inaccuracies.

4. Avoid Opening New Credit Accounts: New credit inquiries can temporarily lower your score. Try to limit applying for new credit at least six months before applying for a mortgage.

5. Keep Old Accounts Open: The length of your credit history impacts your score. Keeping older accounts open helps demonstrate a longer credit history.

What to Do If Your Credit Score Is Low

If your credit score is lower than desired, there are still options available to you. One option is to work with a lender who specializes in helping buyers with less-than-perfect credit. These lenders may require a higher down payment or charge higher interest rates, but they can make it possible to get approved.

Another option is to consider government-backed loans like FHA or VA loans, which are often more flexible with credit requirements. If you’re not in a rush to buy, consider taking time to improve your credit score before applying.

The Bottom Line

Your credit score plays a critical role in the mortgage approval process and can significantly impact the terms of your loan. While a higher credit score opens the door to better interest rates and loan terms, options are still available for those with lower scores. By understanding the minimum credit score requirements for different types of loans and taking steps to improve your credit, you can increase your chances of getting approved and securing favorable terms.

Before you start the mortgage application process, review your credit report, work on improving your score if needed, and research various lenders and loan types to find the best fit for your financial situation.

Hello welcome to my real estate service blog