Mortgage rates are a critical factor that can make or break a homebuyer’s ability to purchase a property. In 2024, these rates continue to shape the housing market in significant ways, influencing buyer behavior, home prices, and market dynamics. Understanding how mortgage rates impact housing trends can help prospective buyers, sellers, and real estate professionals navigate the market more effectively. Here’s a closer look at how mortgage rates are shaping housing trends in 2024.

1. Higher Mortgage Rates Are Changing Buyer Priorities

In 2024, mortgage rates are expected to remain elevated compared to the historical lows of the past decade. This shift has had a profound effect on buyer priorities. With higher monthly mortgage payments, many buyers are re-evaluating what they can afford and prioritizing value for money. Features such as energy efficiency, smart home technology, and well-designed spaces that maximize square footage are increasingly important to buyers looking to get the most out of their investment. As affordability becomes a pressing concern, many buyers are opting for smaller, more manageable homes or moving to areas where property prices are lower.

2. A More Competitive Market for First-Time Homebuyers

Higher mortgage rates have created significant challenges for first-time homebuyers. These buyers, often on tighter budgets, face the dual impact of increased mortgage payments and higher home prices due to inventory shortages. While some may be priced out of the market, many are opting for less expensive neighborhoods or looking into government programs designed to assist first-time buyers. This demographic shift is influencing the type of homes that are in demand, with smaller single-family homes and condos becoming more desirable.

3. A Shift Toward Adjustable-Rate Mortgages (ARMs)

As mortgage rates remain high, more buyers are considering adjustable-rate mortgages (ARMs) as a way to manage their payments. ARMs typically offer a lower initial rate compared to fixed-rate mortgages, which can make them an attractive option for buyers who anticipate that rates may decrease in the future. While ARMs come with some risk due to potential rate adjustments, many buyers are willing to take that gamble if it means lower initial payments. This trend could lead to a rise in the number of ARM agreements, impacting the stability of the housing market over time.

4. Homeowners Staying Put

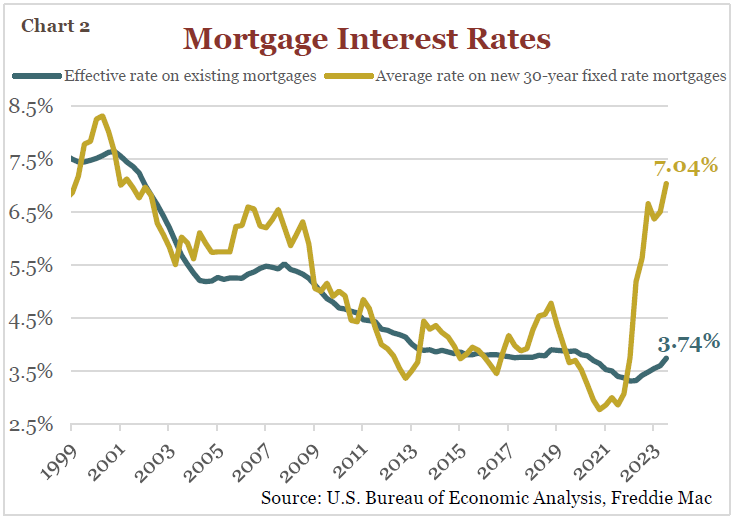

With mortgage rates still on the higher side, many current homeowners are choosing to stay put rather than sell their homes and purchase new ones. This trend, often called the “lock-in effect,” has contributed to a limited inventory in the housing market. Homeowners with lower mortgage rates are reluctant to sell because they would face significantly higher rates when buying their next property. As a result, inventory remains constrained, which has implications for home prices and buyer competition.

5. The Rise of Multi-Family and Income-Generating Properties

As buyers look for ways to make their homeownership more financially viable, multi-family properties and homes with rental potential are seeing increased interest. Properties that offer opportunities for supplemental income, such as those with in-law suites or separate rental units, are becoming more desirable. This trend is particularly popular among first-time buyers and younger homebuyers who are looking for ways to offset mortgage costs and make their monthly payments more manageable.

6. Relocation and Suburban Growth

Higher mortgage rates have also influenced a shift in where buyers are looking to purchase. Suburban and rural areas are seeing increased interest as buyers seek more affordable housing options compared to urban centers. The trend of working remotely and hybrid work models have further fueled this demand. With the cost of city living becoming more prohibitive, many buyers are moving to less densely populated areas where they can get more value for their money. This shift is causing home prices in suburban areas to rise, and neighborhoods that were once considered less desirable are becoming more competitive.

7. Luxury Market Shifts

The luxury housing market is also being impacted by mortgage rate trends. While high-end buyers are less affected by the monthly costs due to their greater purchasing power, higher rates can still impact their decisions. Some wealthy buyers are opting for larger down payments or all-cash offers to avoid interest rate costs altogether. This has led to a more selective market where luxury buyers are seeking unique, high-value properties that can offer long-term investment potential. The luxury market may not see the rapid growth it did during the lowest mortgage rate periods, but it remains active with specific demands for high-quality, customized homes.

8. The Importance of Financial Preparation for Buyers

With mortgage rates shaping housing trends, financial preparation is more important than ever. Buyers need to be ready for higher monthly payments and factor this into their budget planning. This includes understanding the total cost of homeownership, which goes beyond just the mortgage payment to include property taxes, insurance, and maintenance. Buyers should be proactive in getting pre-approved for a mortgage and exploring options to secure the best rates. Consulting with financial advisors and mortgage professionals can help buyers navigate the changing market landscape more confidently.

9. Increased Interest in Refinancing as Rates Stabilize

While mortgage rates in 2024 may still be higher than previous years, they could potentially stabilize or decrease towards the end of the year. If this happens, homeowners who locked in higher rates over the past two years may consider refinancing to lower their payments. This could provide some relief for homeowners who want to stay in their current homes but wish to lower their monthly expenses. The refinancing trend will be closely tied to the broader economic outlook and any shifts in Federal Reserve policy related to interest rates.

10. Long-Term Effects on the Housing Market

The impact of high mortgage rates in 2024 will likely be felt in the housing market for years to come. These rates are pushing many buyers to rethink their long-term goals, adjusting their expectations and strategies. Homebuilders are responding by constructing more affordable and energy-efficient homes that cater to a wider range of buyers. Meanwhile, the increased demand for multi-family housing and income-generating properties could lead to shifts in local housing markets and development projects.

Conclusion

Mortgage rates are a powerful force that shapes housing trends, and 2024 is no exception. With rates higher than in recent years, the market has become more challenging for both buyers and sellers. However, this period also presents unique opportunities for those who are well-prepared. Buyers should focus on financial readiness, consider adjustable-rate mortgages, and explore options like multi-family homes for added value. Sellers should be aware that a constrained inventory means more competition, but they need to remain flexible to adapt to changing buyer preferences. Understanding these trends will enable everyone involved in the real estate market to make informed decisions in 2024.

Hello welcome to my real estate service blog